on

Wallpaper

- Get link

- Other Apps

The concept of money laundering is essential to be understood for these working in the financial sector. It is a course of by which dirty cash is converted into clear money. The sources of the cash in precise are legal and the money is invested in a method that makes it look like clean cash and hide the id of the legal a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the new customers or maintaining present customers the duty of adopting satisfactory measures lie on each one who is part of the group. The identification of such aspect in the beginning is simple to deal with as a substitute realizing and encountering such situations in a while within the transaction stage. The central financial institution in any nation gives complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such situations.

Smurfs - A popular method used to launder cash in the placement stage. WikiLeaks The logo of WikiLeaks an hourglass with a globe leaking from top to bottom Screenshot Screenshot of WikiLeaks main page as of 27 June 2011 Type of site Document archive and disclosure Available in English but the source documents are in their original language Owner Sunshine Press Created by Julian Assange Key people Julian Assange director Kristinn Hrafnsson editor-in-chief.

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

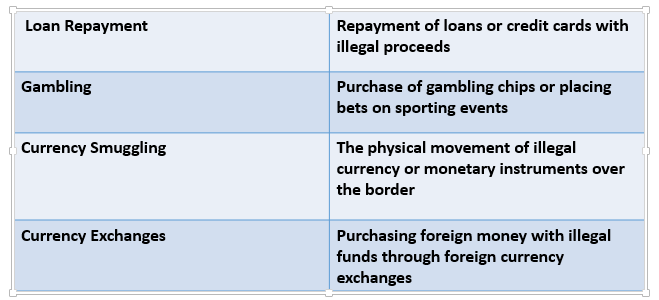

Their illegal source by a series of complex transactions is called:". Global markets consider money laundering a significant white collar crime. Accounting source documents are a form of documentary evidence providing detailed written proof of financial transactions including for example a description of the nature of the. Introducing illegal funds into the formal financial system for example making structured cash transactions into bank accounts.

Illegal arms sales smuggling and the activities of organised crime including for example drug trafficking and prostitution rings can generate huge amounts of proceeds. A transaction is a logical unit of work that contains one or more SQL statements. The layering stage is the most complex and often entails the international movement of the funds.

Embezzlement insider trading bribery and computer fraud schemes can also produce large profits and create the incentive to legitimise the ill-gotten gains through money laundering. Knowledge that the transaction was designed to conceal or disguise the nature location source ownership or control of proceeds of the specified unlawful activity This differs from 1956a1Ai in that intent to promote unlawful activity is not required only knowledge that the transaction conceals some aspect of the unlawful activity. The scope of money laundering proceeds is estimated in the billions to trillions of dollars each year.

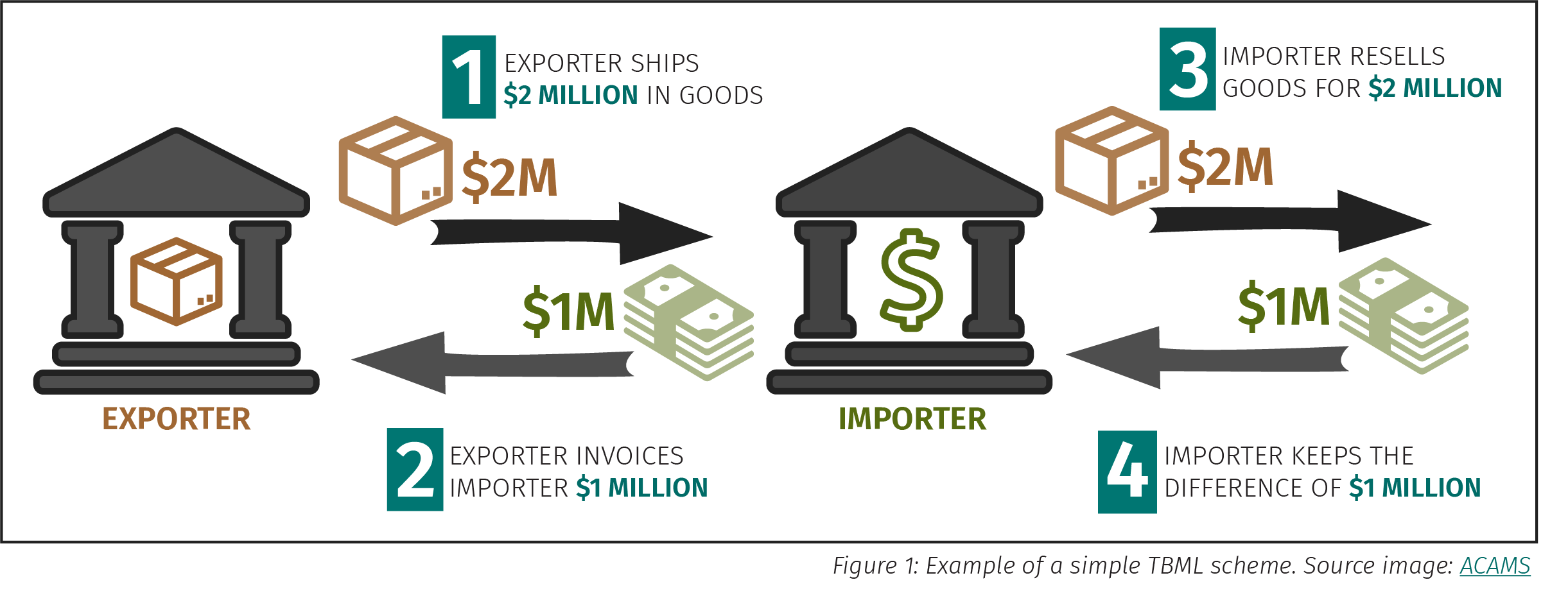

D The total of the subsidiary. Moving dispersing or disguising illegal funds or assets to conceal their true origin for example using a maze of complex transactions involving multiple banks and accounts or corporations and. The Bank Secrecy Act the BSA was enacted by Congress in 1970 as an effort to combat the use of financial institutions in money laundering crimes.

Yes as long as Smith was directly involved in facilitating the transaction. Placement puts the dirty money into the legitimate financial system. It can often be the most complex stage of the laundering process.

The Act contains laws that require financial institutions to report certain transactions to the United States Department of Treasury including transactions in excess of 10000. This technique involves the use of many individuals thesmurfs who exchange illicit funds in smaller less conspicuous amounts for highly liquid items such as traveller cheques bank drafts or deposited directly into savings accounts. This is often done by exchanging illegal funds in smaller and less conspicuous amounts.

Money laundering involves the use of processes to disguise an original source of funds or assets that are generated through criminal activities such as drug trafficking fraud smuggling corruption or extortion. Layering The next stage of money laundering attempts to separate the money from its original illegal source. A transaction is an atomic unit.

C The subsidiary ledgers play an important role in maintaining the accuracy of the data stored in the AIS. A Every credit sale is entered individually into the subsidiary ledger. Layering is the process of making the source of illegal money as difficult to detect as possible by progressively adding legitimacy to it.

According to the federal law money laundering occurs when someone attempts to conceal or disguise the nature the location the source the ownership or the control of the proceeds of unlawful. A transaction begins with the first executable SQL statement. No only the buyers attorney can share a commission with attorneys.

Yes as long as Smith is a licensed attorney. Layering is the stage where the illicit money is blended with legitimate money or placed in constant motion from one account to another. This is the most dangerous aspect of the operation as large amounts of cash attract.

This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. One of the fundamental accounting concepts is the verifiable and objective evidence concept which states that financial transactions should have adequate documentary evidence. The first is called placement in which the dirty money is deposited into a legitimate financial institution.

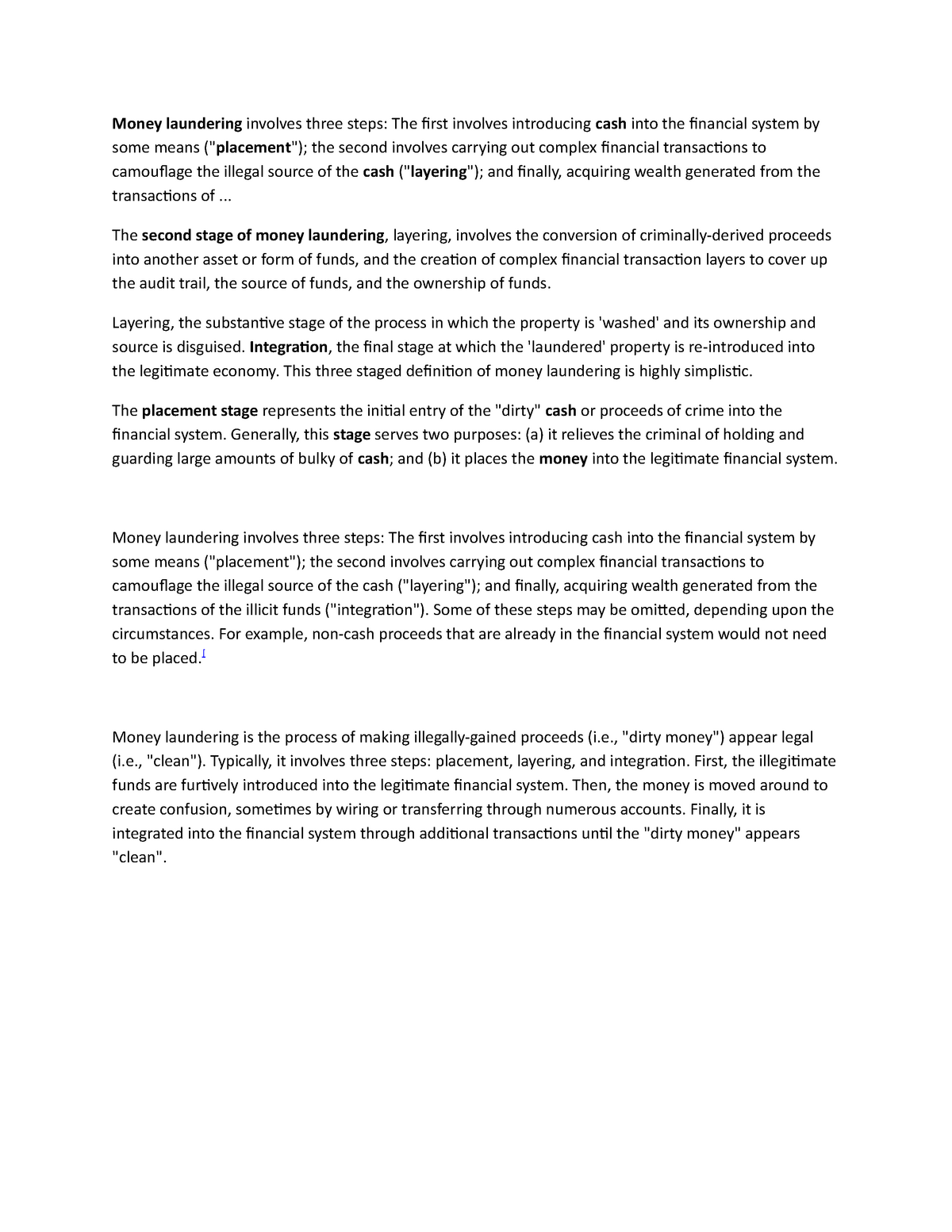

The process of laundering money typically involves three steps. Layering often involves generating so many different transactions. Placement layering and integration.

No brokers are prohibited from sharing their commissions with attorneys. The Layering Stage Camouflage. Layering is the second stage of laundering money and it involves making the money as hard to detect as possible and further moving it away from the illegal source.

B Debits and credits in the subsidiary ledger must always equal. The funds may be exchanged for other liquid forms of cash such as traveler checks bank drafts or savings account deposits. Like placement layering further distances criminal proceeds from their source but it primarily serves to reinforce the appearance of legitimacy by passing money through layers of transactions or financial instruments.

The effects of all the SQL statements in a transaction can be either all committed applied to the database or all rolled back undone from the database. In simplest terms money laundering involves the transfer money obtained from criminal activity into legitimate channels to disguise its illegal origins. Here the illicit money is separated from its source.

What Is Anti Money Laundering Aml Anti Money Laundering

What Is Money Laundering And How Is It Done

What Is Anti Money Laundering Aml Anti Money Laundering

Definition Stages And Methods Of Money Laundering Indiaforensic

Process Of Money Laundering Placement Layering Integration

Tnrc Introductory Overview Trade Based Money Laundering And Natural Resource Corruption Pages Wwf

Understanding Money Laundering European Institute Of Management And Finance

Money Laundering Stages Methods Study Com

Process Of Money Laundering Placement Layering Integration

Anti Money Laundering Key Pdf Money Laundering Banks

What Are Some Largely Used Money Laundering Methods Tookitaki Tookitaki

The world of laws can seem to be a bowl of alphabet soup at times. US cash laundering rules are not any exception. We've got compiled a list of the top ten cash laundering acronyms and their definitions. TMP Risk is consulting firm focused on defending financial companies by reducing threat, fraud and losses. Now we have large bank expertise in operational and regulatory threat. We've a powerful background in program administration, regulatory and operational danger as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many hostile penalties to the organization because of the dangers it presents. It will increase the likelihood of major dangers and the opportunity value of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment