on

Wallpaper

- Get link

- Other Apps

The idea of cash laundering is very important to be understood for these working in the monetary sector. It is a course of by which soiled money is converted into clean cash. The sources of the cash in precise are prison and the money is invested in a method that makes it seem like clean cash and hide the identity of the criminal part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the new prospects or maintaining present clients the duty of adopting sufficient measures lie on every one who is a part of the group. The identification of such element to start with is straightforward to take care of as a substitute realizing and encountering such situations in a while in the transaction stage. The central bank in any nation supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such situations.

The purpose of the National risk assessment on terrorist financing in Denmark 2019 NRA TF is to assess the risk of terrorist financing in Denmark and identify analyze and assess the risks which affect it. It is essential that Member States apply a risk-based approach in order to ensure that the measures implemented to prevent or mitigate terrorist financing activities are commensurate with the risks iden-.

Financial Crime Risk Assessment Acams Today

Terrorist financing risk assessment. When assessing the risk of particular transactions reporting entities should consider the exposure through the remittance and exchange sectors of Qatarwhile at lower risk of terrorist financing activity than other countries in the regionto higher risk jurisdictions Pakistan and Afghanistan in particular. Objective of National Risk Assessment 11. Both documents have informed the risk assessment methodology used here particularly in relation to the use of qualitative and quantitative information.

ISIS Hizballah AQAQAPANF Al Shabaab. It seeks to further deepen the understanding by law enforcement agencies supervisorsregulators and the private. The report provides a systematic analysis3 of the money laundering or terrorist financing risks of.

Hong Kong therefore recognises the need to conduct the risk assessment in response to these developments. It also intends to determine the direction of risks based on the emerging and. The Terrorism Financing National Risk Assessment.

This summary report of ermudas 2020 Terrorist Financing National Risk Assessment TF NRA provides highlights of the analysis and the underlying rationale while also providing key information on the methodology used for the identification and analysis of TF risk factors. This risk assessment is an update to the Second National Risk Assessment NRA specifically on the understanding and assessment of terrorism and terrorism financing TF risks in the Philippines. This RRA aims to assess the modes collection transfer.

Hong Kong has made reference to the FATF Guidance on National Money Laundering and Terrorist Financing Risk Assessment and adopted the World Bank Tool in conducting its first territory-wide risk assessment. Laundering and Terrorist Financing Risk Assessment FATF 2013 provides guidance on risk assessments in general. Relevant component agencies bureaus and offices of Treasury the Department of Justice.

In its assessment report the United States addressed key terrorist organizations that are targeting Americans for donations or support eg. The FATF requires each country to identify assess and understand the terrorist financing risks it faces in order to mitigate them and effectively dismantle and disrupt terrorist networks. Regional Risk AssessmentRRA for assessing the risks of terrorist financing in the Southeast Asia region including Indonesia Singapore Malaysia the Philippines Thailand Brunei Darussalam as well as Australia and New Zealand with the titles.

Money launderingterrorism financing risk assessment. National Terrorist Financing Risk Assessment INTRODUCTION The National Terrorist Financing TF Risk Assessment identifies the TF risks that are of priority concern to the United States. The outcome of this work was a.

This NRA is also intended to. The 2016 RRA on Terrorist Financing. An assessment of the risk of Jersey being used as a conduit for the funding of terrorist activity has been published today Tuesday 20 April.

In 2018 the United States released its Terrorist Financing Risk Assessment an update from its 2015 assessment. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. The 2018 National Terrorist Financing Risk Assessment2018 NTFRA identifies the terrorist financing TF threats vulnerabilities and risks that the United States currently faces updating the 2015 National Terrorist Financing Risk Assessment 2015 NTFRA.

Need to identify and assess the risks of terrorist financing within their economies. United States Terrorist Financing Risk Assessment. The purpose of the National TF Risk Assessment is to identify and understand the.

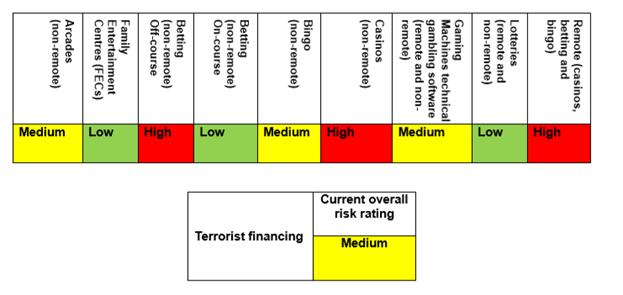

This is Irelands first money laundering and terrorist financing MLTF national risk assessment NRA and the aim of this process was to identify understand and assess the money laundering and terrorist financing risks faced by Ireland. Terrorism Financing National Risk Assessment 2020. National Risk Assessment of Terrorist Financing concludes that the risk of either financial services or non-profit organisations being used to fund terrorism is medium-low.

This Terrorism Financing National Risk Assessment TF NRA is the culmination of experience and observations from all relevant competent authorities over the past few years and includes inputs from the private sector and academia. It is the first thing you must do because it determines what measures you need to include in your program. Risk assessment published in 20172 It assesses the implementation of the Commissions recommendations and evaluates remaining risks including in new products and sectors.

Jersey must conduct a further risk assessment of NPOs that are at higher risk of being involved in terrorist financing and also conduct a risk assessment of how virtual asset service providers VASPs operating in or from within Jersey might be exposed to terrorist financing risk. Countries often face particular challenges in assessing terrorist financing risks due to the low value of funds or other assets used in many instances and the wide variety of sectors misused for the purpose of financing terrorism.

Documents Financial Action Task Force Fatf

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs

Anti Money Laundering And Counter Terrorism Financing

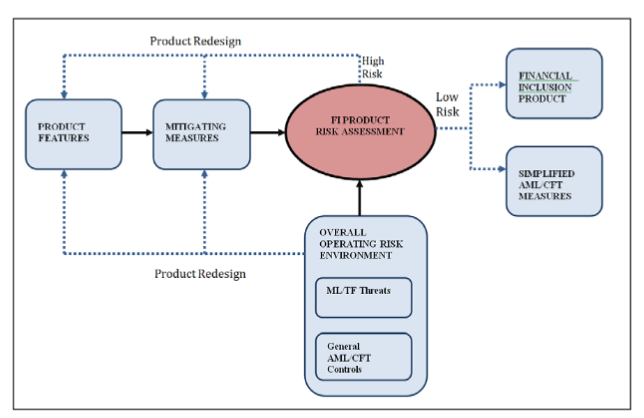

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

Money Laundering And Terrorist Financing Risk Assessment 2018 Lexology

Anti Money Laundering And Counter Terrorism Financing

Combatting Money Laundering And Terrorist Financing Government Se

Risk Assessment Support For Money Laundering Terrorist Financing

News Financial Action Task Force Fatf

Money Laundering And Terrorist Financing Risk Assessment 2020

Risk Assessment Support For Money Laundering Terrorist Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

The world of laws can appear to be a bowl of alphabet soup at occasions. US cash laundering regulations are not any exception. We now have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Threat is consulting firm targeted on protecting monetary services by lowering threat, fraud and losses. We have now big financial institution experience in operational and regulatory threat. We've a strong background in program administration, regulatory and operational threat as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many adverse penalties to the organization as a result of dangers it presents. It will increase the likelihood of main risks and the opportunity cost of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment